Jason R. Rubin is an entrepreneur, real estate investor and real estate attorney based in South Florida. He specializes in handling complex real estate matters and advises investors on strategies that help mitigate risk and maximize returns. In addition, Jason serves as Chief Development Officer for Richr, a real estate PropTech/FinTech startup dedicated to creating a more streamlined, equitable, and all-inclusive real estate buying and selling experience. Mr. Rubin holds a Bachelor’s Degree in Business Administration from The George Washington University and also holds a Juris Doctor Degree from Nova Southeastern University’s School of Law.

As we kick off 2023, there is widespread conjecture in the market regarding the state of the economy. For nearly a year, attention has been directed at gasoline prices, the housing market, consumer spending, and how these factors, among others, have affected the inflation rate. Traditionally speaking, the Federal Reserve has aimed to maintain an inflation rate of approximately 3.3%; however, for most of 2022, the rate was in excess of 7.5%. Something has to be done to ensure economic balance.

Traditionally, the Federal Reserve has relied on Monetary Policy — in simple terms, the movement of interest rates to control the supply and demand of money — to combat inflation or (as was needed through COVID) to kickstart the economy. Given our persistent inflation levels, we expect interest rates may be one of the tools employed this year to combat inflation. However, how many and how steep the interest rate movements are remains to be seen. This will be a combination of what happens next in the economy and what the effects of last year’s rate hikes are, as the movements the Federal Reserve has made to date are likely suffering from a lag effect—-albeit, they have started to affect the housing market and will, in all likelihood, continue to do so.

In this, the first in a two-part series looking at impacts on the residential housing market, we will look at interest rates and recent environmental disasters and what may occur as a result.

Some Key Facts

Demand dynamics in America have changed somewhat aggressively in recent years and, in doing so, contributed to the current economic situation. This has been driven in part by the hangover of COVID-19, years of fiscal stimulus in the trillions of dollars, energy wars resulting from the Ukraine-Russia crisis, environmental changes, inflation in other countries and, ironically, a slowing in dominant economies such as China, which has affected the supply of specific goods and materials. It has been a perfect storm, culminating in the economy overheating and resulting in interest rate movements.

To put into context the reason why the Fed has made a series of adjustments to the official cash rate, consider this:

- U.S. inflation has averaged 1.9% over the past ten years.

- However, through most of 2022, the annual inflation rate was in excess of 7.5%.

- In the last year, inflation has been led by strong price growth for core (non-food, non-energy) products.

- The U.S. experienced high rates of inflation in the 1970s and early 1980s, which saw interest rates of 19-20% that aimed to curb growth and inflation.

At the same time, consider the fact that, cumulatively, over the last five years, the total cost of natural disasters in America totaled $788.4 billion. On it’s own, this figure is significant, but the fact that the total of these five years alone accounts for more than one-third of the total for all disasters over the last 43 years, is shocking.

Not all storms and environmental events have led to to the government declaring natural disasters; however, what this figure does represent is a worsening of the climate in a way that has led to significant insurance claims that, in turn, have led to insurance companies needing to increase their premiums.

These premium rises are, in their own right, adding to inflationary pressures faced by households. In fact, statistics show that insurance premiums have more than doubled in the twenty years since 2002.

Historical vs Current Rates

In the last year, interest rates have escalated quickly and in large increments. The intent has been to curb economic and price growth to manageable levels and put a brake on inflation.

When you consider that inflation is currently at levels that far exceed what was seen in 1990, it could be reasonably expected that there will be significant movement upwards of rates, even from the levels we are at today.

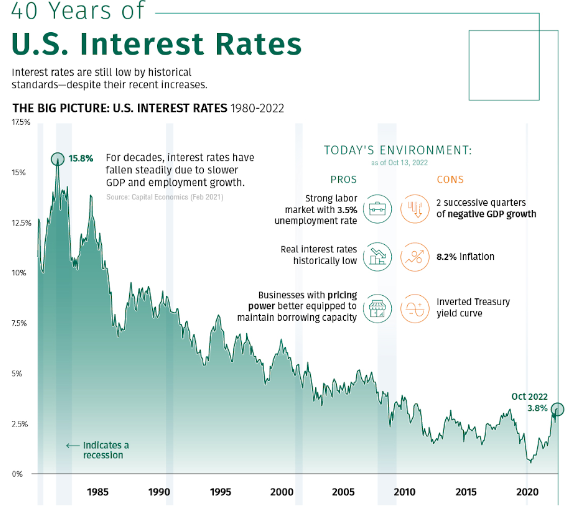

The truth is, however, that while interest rates are climbing and starting to affect the property market in some ways, the current market rates are at the bottom end compared to figures seen over the last 40 years, while inflation is at higher levels than during comparable periods. In fact, when you review the year 1990, inflation sat at 5.4% and interest rates at 7.9%. Currently, U.S. inflation is trending towards more than 8% for 2022, with interest rates sitting at 4.25%.

Perhaps the easiest way to visualize this is to view the below graph from Visual Capitalist, showing just how low-interest rate levels are compared to historical rates.

What it Means

Simply put, the cost of living in America is increasing steadily. Households and homeowners are bearing a significant proportion of this. Groceries, rental costs, insurance premiums, general household goods, and services are all increasing and, in doing so, driving inflation higher. As inflation increases, the Federal Reserve is going to continue pulling the rates lever, attempting to slow the economy and bring real growth back in line with expectations. This will be passed onto mortgagees by way of higher mortgage repayments. A corollary to this will be an eventual softening of the housing market and lower house prices.

None of this is ideal for homeowners or residential investors who are looking to maximize/or preserve their wealth. However, there are still opportunities that will exist for people looking to buy property.

If you would like to discuss how we can help with your property purchase or renting out an existing property, and how to minimize your exposure, please reach out to our offices—we’d be happy to help you.